Covid, shaking supply chain, Russia invading Ukraine, shaking supply chain, inflation, shaking supply chain, energy crisis, shaking supply chain, government regulations, shaking supply chain, super-dynamic competitive market, shaking supply chain, thinner margins, cost cuttings, layoffs, shaking supply chain.

This was daily bread in 2021–2022 for a major part of retail chain managers. Different from anything they’ve had to face over the 10 years before.

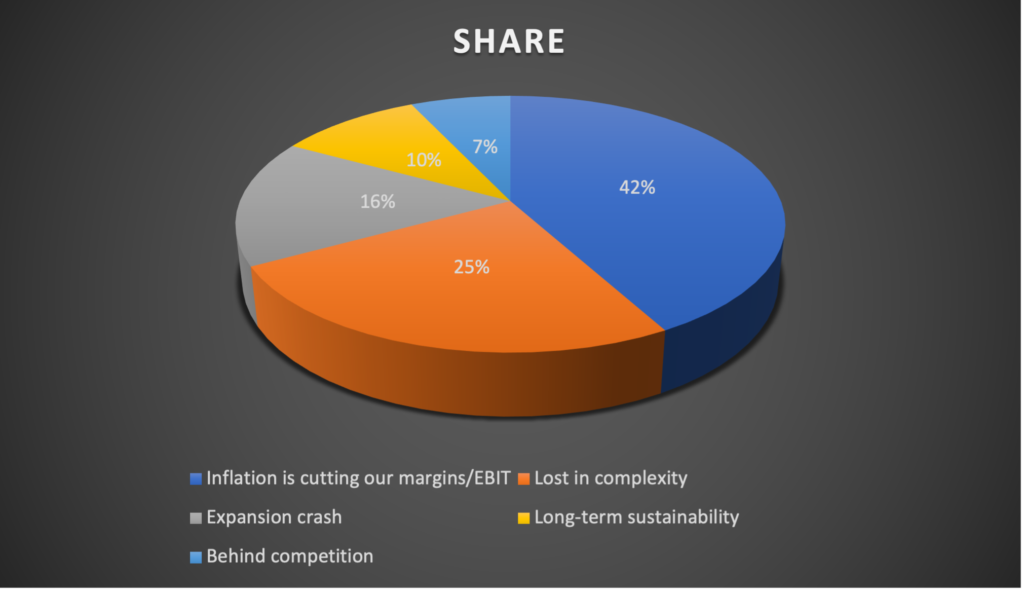

More than 200 retail CEOs, CCOs, Pricing Directors, Pricing Managers and Analysts, and Category Managers/Buyers, talked to us in 2022 about improving their pricing capabilities and overcoming the obstacles above. We are now putting this in a chart and finding out the primary reason that provoked them to action. Yes, pricing is complex and agendas overlap. But we are all human beings from muscles, tears, blood, and limited daily time, and we all have an answer when asked: “What made you raise the topic of pricing both internally and now with us?“ We will go straight to the point, this is a report, not a book.

Inflation is cutting our margins/EBIT – 42%

-

- Manufacturers are pushing buying prices up. Smaller retail chains have trouble negotiating buying prices they can afford. This has always been valid. Now it has critical impacts for smaller retail chains operations.

- Retail chains from countries with inflation over 15% talk to us about controlling their overhead costs, EBIT, that are shaken due to inflation causes and impacts, and expensive energy.

- “We have trouble reacting promptly to the supply chain changes and precisely recalculating all prices whose buying price has changed recently.“ Yes and moreover they say, those price recalculations must be aligned precisely with the actual pricing strategy, executed promptly. Typically, they remain alone and not supported by excellent execution.

- Overhead costs, expensive energy for stores and supply chains put increased pressure on sales margins. Labor costs cut EBIT – increase automation of everyday price management is demanded. In total, as well as to automate particular pricing processes or capabilities to mitigate the risks above:

- Buy-more-pay-less has taken historically up to 15 % of Category Manager/Buyer working time. Retail chain CCOs are asking themselves if they can afford to continue like that.

- Families management (linkage of same flavor products, and same product sold in different package sizes = family) has historically taken up to 5 % of Category Manager/Buyer working time.

- What-if simulation has taken historically weeks. CCO: “If we were more aggressive on KVIs and go down with CPI by 1 P.P., and vice versa increase margin on long tail categories Canned and Biscuits and two more (tell me which ones might be good candidates), what is going to be the total impact?“ Response “I need one month and I’ll run the necessary analytics“ is simply not enough anymore for 2022 and further.

Lost in complexity – 25%

-

- As a consequence of the above-mentioned situations, we hear:

- “We have opened a new store/city/region/e-shop and we are not able to handle it with our current pricing capabilities.“

- “We are about to implement a new pricing strategy that is twice as complex and thus impossible to be managed with our current pricing capabilities.“

- “We want to run multiple price zones with specific price lists.“

- “We want to threaten different competitors differently in different locations.“

- “We want to apply different pricing to KVIs versus long-tail.“

- “Private labels vs. national brands.“

- “External effects not reflected until now: Season, Weather, Store location, Different inflation impacts across the country, etc.“

- “Recently talked to our 25 Category Managers. They combine 18 data sources, each does it in his own Excel sheet. Some of them manually check data for errors, some not. They have KPIs on margin but totally different ways of how to hit those, they would not agree even together on the data and conclusions. The CEO wants me to manage this fleet?“

- As a consequence of the above-mentioned situations, we hear:

Expansion crash – 16%

-

- New stores/regions/cities openings, either organic or through acquisition are still planned. Later in 2023 we might witness some acquisition of smaller retail chains that have fallen under financial pressure.

- Increasing value and technological value before acquisition/merge happen.

- Managers are aware that with one country run historically, processes must change when entering 2 new markets. Same with stores/regions/cities/e-shops and other channels.

Long-term sustainability – 10%

-

- 50 %+ retail chains managers put pricing on the regular board’s agenda. Now they discuss different new strategies that should be implemented shortly in 2023. Pricing is discussed in all dimensions – assortment, stores, channels, operations, ownerships, reports, deliverables. To get their decision-making actionable, they are in a need of immediate – same-day or the day after – responses from their price-responsible teams.

- New pricing teams are being established. We haven’t witnessed that many retail companies establishing any new team until 2022 in the domain of pricing. The problem with retail pricing managers is that they are not in the market. Retail is not the native market of pricing, unlike airlines, hotels, shared services etc. These people are simply not there; therefore, retail chain managers tend to slim pricing teams that can multiply their power and impact via smart price management tools. Same as airplanes – to have one person for the left engine, one for the right engine, one for flaps, one for directional flaps, one for landing gear etc. would require at least 20 people just to take off. But we all fly airplanes with just two pilots, right?

- New pricing tools are super-intuitive and can serve well both advanced pricers as well as domain beginners. Like a fast car – can serve for safe transport as well as circuit entertainment.

Behind competition – 7%

-

- Retail evergreen. We had to place it here for those who enjoy staying in the shadow of their competitors and the flower-role.

- Some managers are afraid of new competitors entering their market, either organically or through acquisition. Until now pricing hasn’t been on their radar, but with a new price-aggressive competitor in the market, they must change it.

- Follower-ship: “We can see that our major competitor moves this way and has implemented a new pricing tool in 2022“ as well as: “We were advised by our mother company to implement a new pricing tool“ as well as: „Our BIG4 consultants advised us to implement a new pricing tool.“ External stimulus is fine, but the internal one still remains more impactful.

- Minority of retail chains aspire to overtake the price leader position in their market.