The harsh reality is that CXOs often have poor visibility and little to no control over pricing. The fact of the matter is that it’s usually hard for them to control pricing, so they resort to leaving prices and margins to their own devices, despite prices and margins being an unquestionably critical part of literally any upper management or Board of Directors role. How much should CXOs really have to tolerate when it comes to ineffective approaches to pricing?

CXOs typically have to deal with painfully slow and reactive pricing tactics within their teams, which are insufficient to support their decision making–they need the right answers within hours, a few days, or in one-week’s time, at most. Some CXOs might have the support of dedicated pricing professionals and teams. But, many CXOs still rely on a Buying Manager, whose job is to negotiate with suppliers, rather than calculate the best shelf prices that reflect the most recent changes in the company’s overall pricing strategy.

We’ve spoken with 28 retail CXOs who are primarily in the grocery, drug store, and DIY retail chain industries. Here in this article is what they said was the cost of not using a pricing tool in their retail chains.

Let’s jump straight into this compelling list of statistics that are sure to trigger your thought processes–if we made it into a book, it would likely make you cry. We have even compiled highlights of the most interesting and insightful responses to support the metrics we obtained from our discussions with the 28 CXOs who participated.

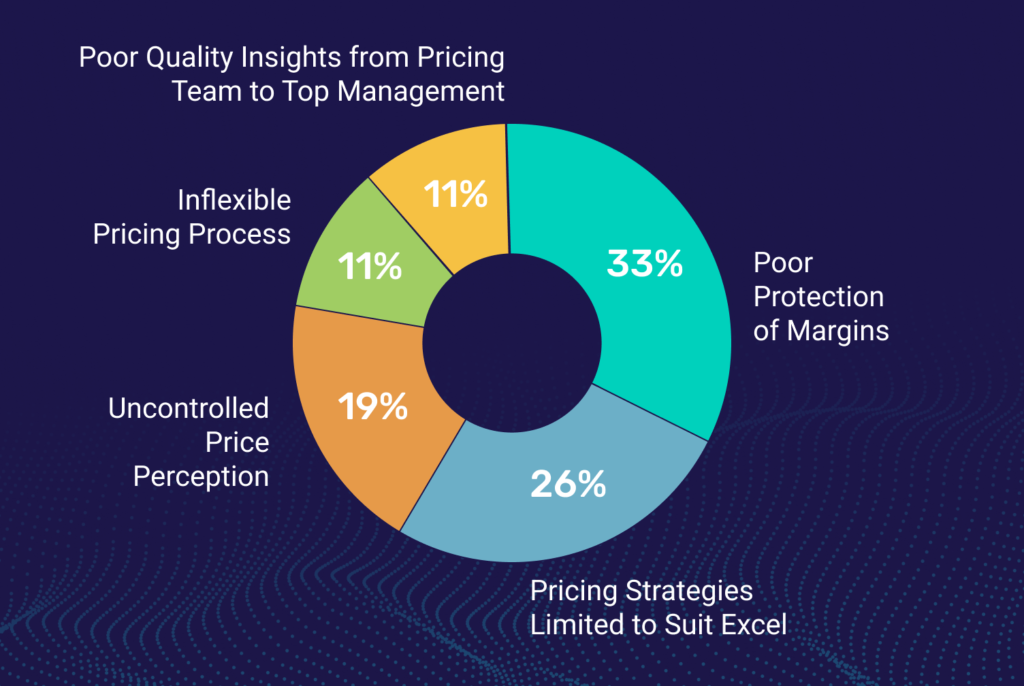

Poor Protection of Margins – 33 %

- Quick math: EUR 1B sales revenue at 20 % sales margin (PP) is EUR 200M in sales margin, and with 2.6 % of losses in sales margin (typical finding), that equals 5.2M in total losses; therefore, per each EUR 100,000 salary, this would be the equivalent of 52 FTEs.

Pricing Strategies Limited to Suit Excel – 26 %

Highlighted Responses:

- “It was frustrating not to be able to adapt our pricing strategy to our company goals year-round.”

- “Who has ever implemented a good pricing tool, and still balances margins and sales by the end of each FY manually, and under the stress of an unknown outcome?”

- “We are not able to steer different price strategy goals, maximization of profit, maximization of % margin, maximization of turnover, all differently for different categories, departments, regions, and so forth.”

- “Absence of data-driven pricing: price elasticities, cannibalization, ML tools.”

Uncontrolled Price Perception – 19 %

Highlighted Responses:

- “Before, when trying to protect our margins, we typically harmed our sales.”

- “Due to the limits of Excel, we have been unable to price differently to different competitors, and consider different major competitors across our regions.”

- “We have never ever had the competition price index linked to our margin.”

- “Without a tool, we have only been able to keep our KVIs at a price-competitive level.”

Inflexible Pricing Process – 11 %

Highlighted Responses:

- “With a dedicated pricing tool, I’m free of 14 days waiting periods for price-related reports, or simulations.”

- “I’ve never thought that 1 pricing expert can price all SKUs in 285 stores.”

- “Our pricing process was not unified across the departments thus it was less transparent and hard to control.”

- “Slow responses to market changes.”

- “Not ready for combined organic and inorganic expansion of new stores.”

- “Historically without a pricing process in place, we have not been able to train our employees or newcomers on how to price our goods.”

- “Automation of the pricing process.”

Poor Quality Insights from Pricing Team to Top Management – 11 %

- Oftentimes this is an underestimation of internal resources, data quality, corporate/group buy-in, and internal relations.